Finance:Capacity utilization

Capacity utilization or capacity utilisation is the extent to which a firm or nation employs its installed productive capacity (maximum output of a firm or nation). It is the relationship between output that is produced with the installed equipment, and the potential output which could be produced with it, if capacity was fully used.[1] The Formula is the actual output per period all over full capacity per period expressed as a percentage.

Engineering and economic measures

One of the most used definitions of the "capacity utilization rate" is the ratio of actual output to the potential output. But potential output can be defined in at least two different ways.

Engineering definition

One is the "engineering" or "technical" definition, according to which potential output represents the maximum amount of output that can be produced in the short run with the existing stock of capital. Thus, a standard definition of capacity utilization is the (weighted) average of the ratios between the actual output of firms and the maximum that could be produced per unit of time, with existing plant and equipment (see Johanson 1968). Output could be measured in physical units or in market values, but normally it is measured in market values.

However, as output increases and well before the absolute physical limit of production is reached, most firms might well experience an increase in the average cost of production—even if there is no change in the level of plant & equipment used. For example, higher average costs can arise because of the need to operate extra shifts, to undertake additional plant maintenance, and so on.

Economic definition

An alternative approach, sometimes called the "economic" utilization rate, is, therefore, to measure the ratio of actual output to the level of output beyond which the average cost of production begins to rise. In this case, surveyed firms are asked by how much it would be practicable for them to raise production from existing plant and equipment, without raising unit costs (see Berndt & Morrison 1981). Typically, this measure will yield a rate around 10 percentage points higher than the "engineering" measure, but time series show the same movement over time.

Measurement

In economic statistics, capacity utilization is normally surveyed for goods-producing industries at plant level. The results are presented as an average percentage rate by industry and economy-wide, where 100% denotes full capacity. This rate is also sometimes called the "operating rate". If the operating rate is high, this is called "full capacity", while if the operating rate is low, a situation of "excess capacity" or "surplus capacity" exists. The observed rates are often turned into indices. Capacity utilization is much more difficult to measure for service industries.

There has been some debate among economists about the validity of statistical measures of capacity utilization, because much depends on the survey questions asked, and on the valuation principles used to measure output. Also, the efficiency of production may change over time, due to new technologies.

For example, Michael Perelman has argued in his 1989 book Keynes, Investment Theory and the Economic Slowdown: The Role of Replacement Investment and q-Ratios that the US Federal Reserve Board measure is just not very revealing. Prior to the early 1980s, he argues, American business carried a great deal of extra capacity. At that time, running close to 80% would indicate that a plant was approaching capacity restraints. Since that time, however, firms scrapped much of their most inefficient capacity. As a result, a modern 77% capacity utilization now would be equivalent to a historical level of 70%.

Economic significance

If market demand grows, capacity utilization will rise. If demand weakens, capacity utilization will slacken.[1] Economists and bankers often watch capacity utilization indicators for signs of inflation pressures.

It is often believed that when the utilization rate rises above somewhere between 82% and 85%, price inflation will increase. Excess capacity means that insufficient demand exists to warrant expansion of output.

All else constant, the lower capacity utilization falls (relative to the trend capacity utilization rate), the better the bond market likes it. Bondholders view strong capacity utilization (above the trend rate) as a leading indicator of higher inflation. Higher inflation—or the expectation of higher inflation—decreases bond prices, often prompting a higher yield to compensate for the higher expected rate of inflation.

Implicitly, the capacity utilization rate is also an indicator of how efficiently the factors of production are being used. Much statistical and anecdotal evidence shows that many industries in the developed capitalist economies suffer from chronic excess capacity. Critics of market capitalism, therefore, argue the system is not as efficient as it may seem, since at least 1/5 more output could be produced and sold, if buying power was better distributed. However, a level of utilization somewhat below the maximum typically prevails, regardless of economic conditions.

Modern business cycle theory

The notion of capacity utilization was introduced into modern business cycle theory by Greenwood, Hercowitz, and Huffman (1988). They illustrated how capacity utilization is important for getting business cycle correlations in economic models to match the data when there are shocks to investment spending.

Output gap percentage formula

As a derivative indicator, the "output gap percentage" (%OG) can be measured as the gap between actual output (AO) and potential output (PO) divided by potential output and multiplied by 100%:

- %OG = [(AO – PO)/PO] × 100%.

FRB and ISM utilization indexes

In the survey of plant capacity used by the US Federal Reserve Board for the FRB capacity utilization index, firms are asked about "the maximum level of production that this establishment could reasonably expect to attain under normal and realistic operating conditions, fully utilizing the machinery and equipment in place."

By contrast, the Institute for Supply Management (ISM) index asks respondents to measure their current output relative to "normal capacity", and this yields a utilization rate, which is between 4 and 10 percentage points higher than the FRB measure. Again, the time series show more or less the same historical movement.

See Board of Governors of the Federal Reserve System: Industrial Production and Capacity Utilization.[2]

Data

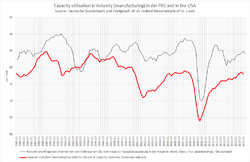

The average economy-wide capacity utilization rate in the US since 1967 was about 81.6%, according to the Federal Reserve measure. The figure for Europe is not much different, for Japan being only slightly higher.

The average utilization rate of installed productive capacity in industry, in some major areas of the world, was estimated in 2003/2004 to be as follows (rounded figures):

Average utilization rate

- United States 79.5% (April 2008 — Federal Reserve measure)

- Japan 83–86% (Bank of Japan)

- European Union 82% (Bank of Spain estimate)

- Australia 80% (National Bank estimate)

- Brazil 60–80% (various sources)

- India 70% (Hindu business line)

- China perhaps 60% (various sources)

- Turkey 79.8% (September 2008 — Turkish Statistical Institute)[3]

- Canada 87% (Statistics Canada)

Notes

- ↑ 1.0 1.1 Baumohl, Bernard (2005). The Secrets of Economic Indicators: Hidden Clues to Future Economic Trends and Investment Opportunities. Wharton School Publishing – University of California. pp. 137–140. ISBN 9780131455016. https://books.google.com/books?id=DT2zAAAAIAAJ. Retrieved 9 January 2023.

- ↑ "The Fed – Industrial Production and Capacity Utilization – G.17". Federal Reserve. http://www.federalreserve.gov/releases/g17/current/.

- ↑ "Turkish Statistical Institute". Turkstat.gov.tr. 9 April 2009. http://www.turkstat.gov.tr/PreHaberBultenleri.do?id=2051.

References

- E. Berndt & J. Morrison, "Capacity utilization measures: Underlying Economic Theory and an Alternative Approach", American Economic Review, 71, 1981, pp. 48–52

- I. Johanson, Production functions and the concept of capacity", Collection Economie et Mathematique et Econometrie, 2, 1968, pp. 46–72

- Michael Perelman, Keynes, Investment Theory and the Economic Slowdown

- Susan Strange and Roger Tooze, The International Politics of Surplus Capacity: Competition for Market Shares in the World Recession (London: Allen & Unwin, 1981).

- James Crotty, "Why there is chronic excess capacity – The Market Failures Issue", in: Challenge, Nov–Dec 2002 [1]

- Jeremy Greenwood, Zvi Hercowitz, and Gregory W. Huffman, "Investment, Capacity Utilization and the Real Business Cycle," American Economic Review, 1988.

- Thomas G. Rawski, "The Political Economy of China's Declining Growth", University of Pittsburgh. [2]

- Anwar Shaikh and Jamee Moudud, Measuring Capacity Utilization in OECD Countries: A Cointegration Method(2004), Working Paper No. 415, The Jerome Levy Economics Institute of Bard College. [3]

- Annys Shin, "Economy Strains Under Weight of Unsold Items", Washington Post, 17 February 2009, A01.

External links

- US survey of plant capacity utilisation

- Capacity utilisation of US industry

- Federal Reserve Statistics

- FAO discussion of concepts and measures

- Measuring capacity utilization in OECD countries

- Economic Reforms and Industrial Performance: An analysis of Capacity Utilization in Indian Manufacturing

|